does idaho tax pensions and social security

For example a divorce is a rare time that allows you early access to your 401k or IRA without a tax penalty if your spouse is awarded part of your account. In this rule the Idaho Child Support Guidelines are referred to as the.

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

There is a formula that determines how much of your Social Security is taxable.

. Using an online Social Security taxation calculator we estimate that 29393 of their Social Security is taxable. Currently West Virginia does tax Social Security benefits but thats changing. 3071HR5723 increases benefits across the board improves the cost-of-living adjustment COLA and benefits for widows and widowers from two-income households and raises the cap on payroll taxes to earnings of 400000 per year.

Below is a screenshot that shows you how the formula works. Does the same hold true today. States currently have unfunded pension liabilities.

Rhode Island provides various tax breaks for Social Security as well as provisions for pension income military retirement pay and retirement funds including 401k and 403b accounts. The wait is longer if your case was decided on. The division of retirement accounts are typically one of the most complex issues in divorce cases.

Some claimants will get their letters even after Social Security has issued their first benefit payment or earlier than that. Dividends pensions interest trust income annuities social security benefits. The newly introduced Social Security 2100 Act.

Now that they are collecting Social Security the tax calculation requires an extra step. One-half of the self-employment social security tax paid on the trade or business income. Utahs legislation provides for a retirement credit of up to 450 for taxpayers who were born on or before December 31 1952.

A Sacred Trust S. There are tax implications and unique rules and laws that apply. It also repeals the Windfall Elimination Provision WEP and.

Gross income does not usually include a. The relative security of a pension is tied to the well-being of the government that offers it and a great many US. D Income of Parents and Spouse.

Private companies rarely offer pensions anymore and states are struggling with pension commitments they made decades ago. The Social Security office does not have an established deadline for mailing the award letters. The 2020 tax year will exempt 35 of Social Security benefits from state taxation.

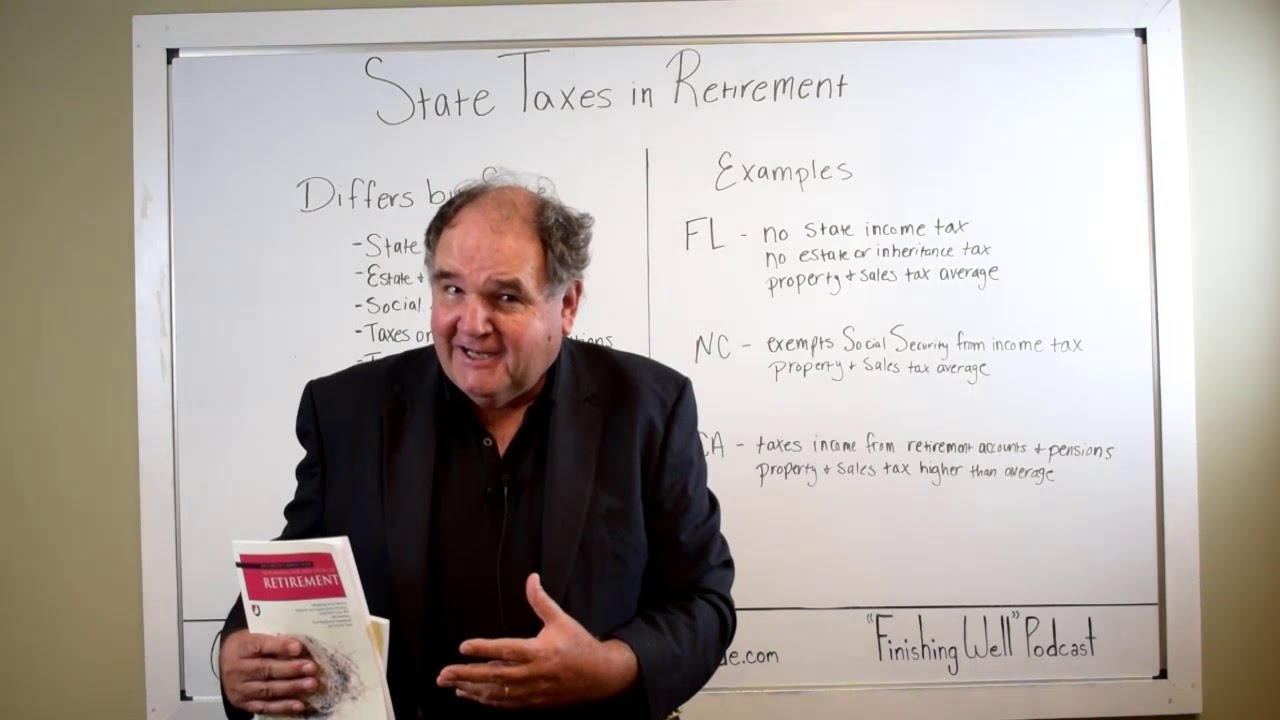

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

Idaho Retirement Tax Friendliness Smartasset

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

37 States That Don T Tax Social Security Benefits The Motley Fool

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

States That Don T Tax Social Security

Idaho Retirement Tax Friendliness Smartasset

Tax Withholding For Pensions And Social Security Sensible Money

Tax Withholding For Pensions And Social Security Sensible Money

These States Don T Tax Military Retirement Pay

State Social Security Administrator 218

Does Idaho Tax Social Security Celebrity Fm 1 Official Stars Business People Network Wiki Success Story Biography Quotes

Idaho Retirement Taxes And Economic Factors To Consider

How Every State Taxes Differently In Retirement Cardinal Guide

Idaho Retirement Tax Friendliness Smartasset

Tax Withholding For Pensions And Social Security Sensible Money

37 States That Don T Tax Social Security Benefits The Motley Fool